A Beginner's Guide to DeFi: What is Decentralised Finance and How Does it Work?

In the world of cryptocurrencies, decentralised finance (DeFi) is a developing area that has attracted significant investment and innovation. DeFi is a new financial system that uses blockchain technology to enable peer-to-peer (P2P) transactions, allowing users to access financial services without going through centralized institutions such as banks or government-issued currencies. With DeFi, users can borrow and lend, access margin trading, invest in new tokens, and trade with other users—all without relying on a third party. This beginner’s guide to DeFi will help you understand how this revolutionary technology works and how it can be used to your advantage.

Table Of Contents

- What is DeFi?

- History of DeFi

- How does DeFi work? Overview of DeFi protocols

- DeFi use cases

- Popular DeFi projects

- DeFi vs. traditional finance

- Benefits of DeFi

- DeFi risks and security considerations

- Conclusion and outlook for DeFi

- DeFi glossary

What is DeFi?

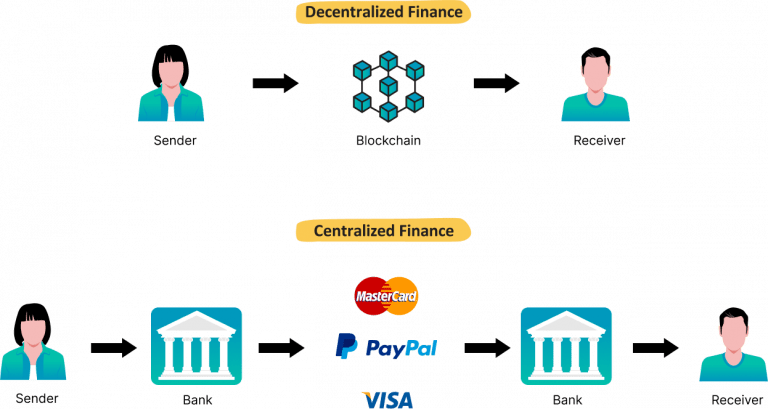

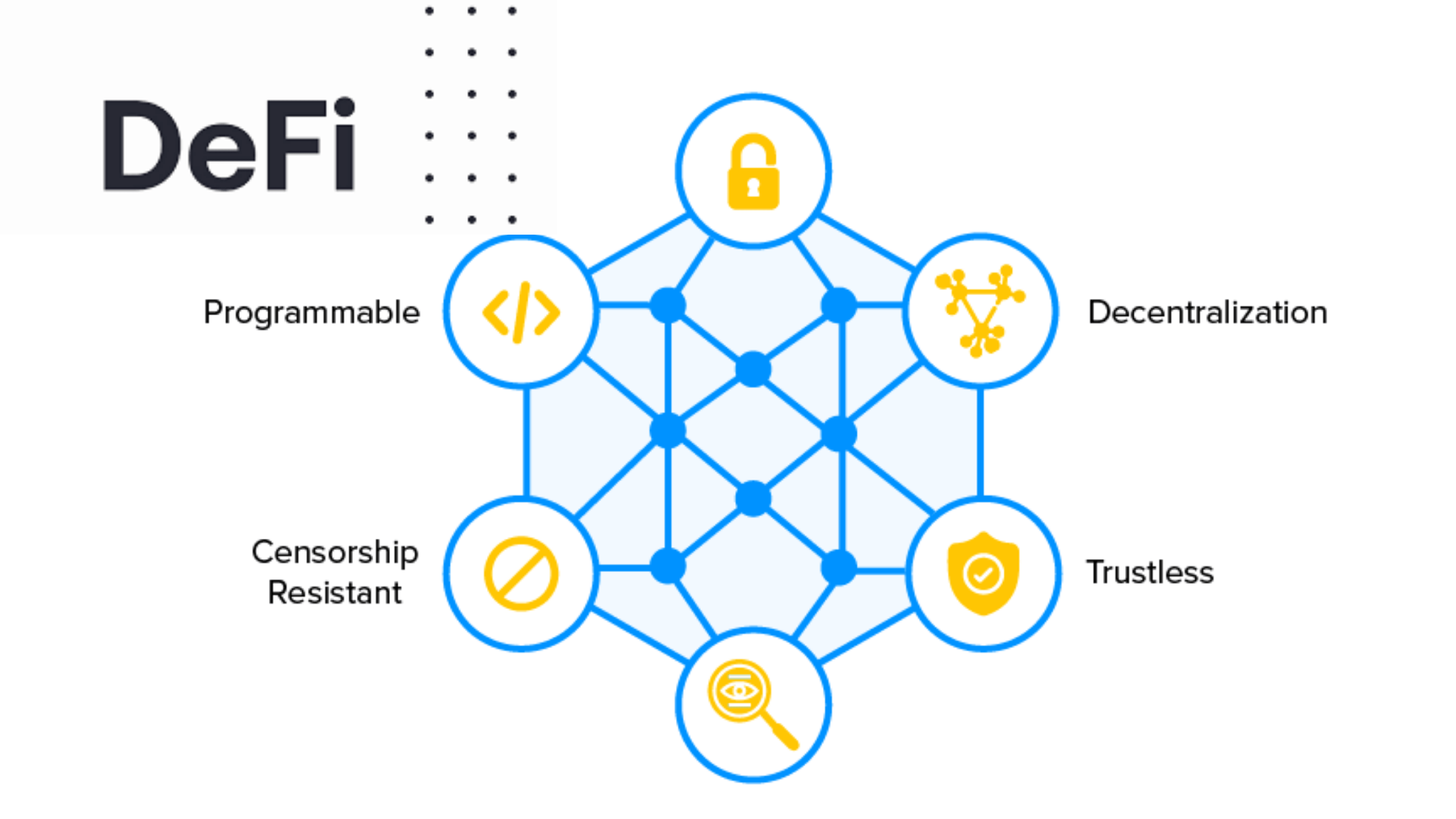

Decentralized finance is the practice of enabling peer-to-peer (P2P) financial transactions through the use of distributed ledger technology (DLT) and blockchain-based systems. The main goal of DeFi is to create a financial ecosystem that doesn’t rely on centralized institutions, such as banks or government-issued currencies.

Users of DeFi can access financial services without going through centralized institutions thanks to the ecosystem’s use of tokens. In an ideal DeFi ecosystem, users can borrow money, lend money, access margin trading, invest in new tokens, and trade with other users without relying on a third party. You can think of DeFi as the Internet of Finance or a new financial system. In this financial system, users interact with each other through a decentralized marketplace where anyone can access services or provide financial products and services. This marketplace operates on a peer-to-peer basis, meaning that users can transact with each other directly without middleman interference.

History of DeFi

Decentralized finance is a relatively new system that has only recently been integrated into the current financial framework. Although centralized financial systems, such as banks, have existed for thousands of years, the first blockchain-based financial transactions took place in 2008, when Satoshi Nakamoto created the first decentralized digital currency, the bitcoin.

Around the same time, the technology behind bitcoin was applied to other systems and networks to enable P2P financial transactions outside of centralized control systems. The Ethereum blockchain, which was released in 2015, was one of the first blockchain networks intended for decentralized finance. Other key DeFi projects include Maker, Compound, Uniswap, AAVE and Curve.

How Does DeFi Work? Overview of DeFi Protocols

DeFi uses a decentralized network architecture to connect financial service providers (FSPs) and users. FSPs are responsible for operating the network, providing services that users request, and connecting to other DeFi networks to enable interoperability.

Users can access the network by downloading a wallet and participating in smart contracts that facilitate transactions. Users can interact with the network by requesting a service, paying for it, receiving it, and providing feedback about the quality of the service. The network is powered by protocols that govern the operation of the network and the interaction between FSPs and users.

The majority of DeFi protocols are built on Ethereum-based smart contracts. However, interoperability is a significant goal for the sector, with efforts underway to connect different networks.

DeFi Use Cases

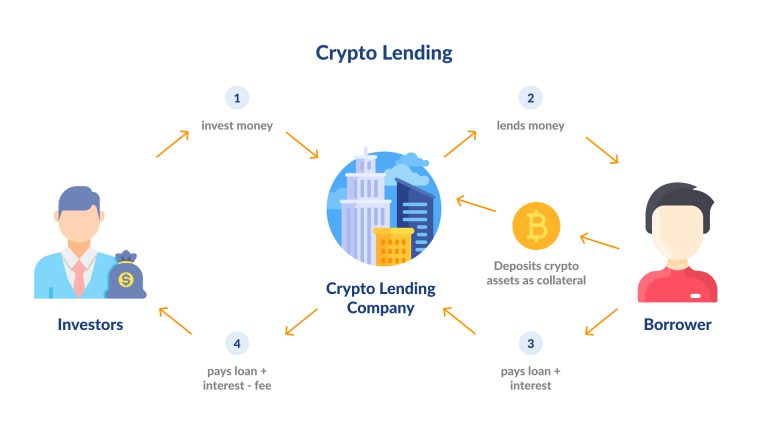

Users can access financial services using DeFi in a variety of ways:

They can borrow money by creating a loan request and offering collateral, lend money by creating a loan request and setting terms for repayment, and invest in new tokens by participating in initial coin offerings (ICOs) and staking tokens as collateral to access loans.

DeFi can also be used for margin trading and the trading of various financial instruments and assets. The decentralized nature of DeFi allows users to transact with each other directly, bypassing traditional financial institutions and intermediaries. Because users can transact directly with one another, they can set their own terms and conditions. This means that people who are currently excluded from the traditional financial system, such as people in developing countries or people who lack a credit history, can still access financial services.

Popular DeFi Projects

Although DeFi is a new and rapidly growing sector of the crypto space, there are already a variety of projects that have become major players in the sector.

1. MakerDAO: MakerDAO is a decentralized finance (DeFi) platform that provides a stablecoin, DAI, which is designed to maintain a value of $1. MakerDAO also offers loans and other financial services on the Ethereum blockchain.

2. Compound: Compound is an open-source protocol that allows users to lend and borrow crypto assets without an intermediary. It has become one of the most popular DeFi protocols, with over $2 billion in assets currently locked in its protocol.

3. Uniswap: Uniswap is a decentralized exchange that enables users to trade tokens without relying on centralized exchanges or brokers. It uses automated market makers (AMMs) to facilitate token trades and has become one of the most popular platforms for DeFi trading.

4. Aave: Aave is a decentralized lending platform that allows users to borrow and lend crypto assets without relying on centralized lenders. It has become one of the most popular DeFi protocols, with over $3 billion in assets currently locked in its protocol.

5. Curve: Curve is a decentralized exchange that offers low-slippage trading of stablecoins and other crypto assets. It is designed to minimize trading costs and has become one of the most popular DeFi protocols, with over $2 billion in assets currently locked in its protocol.

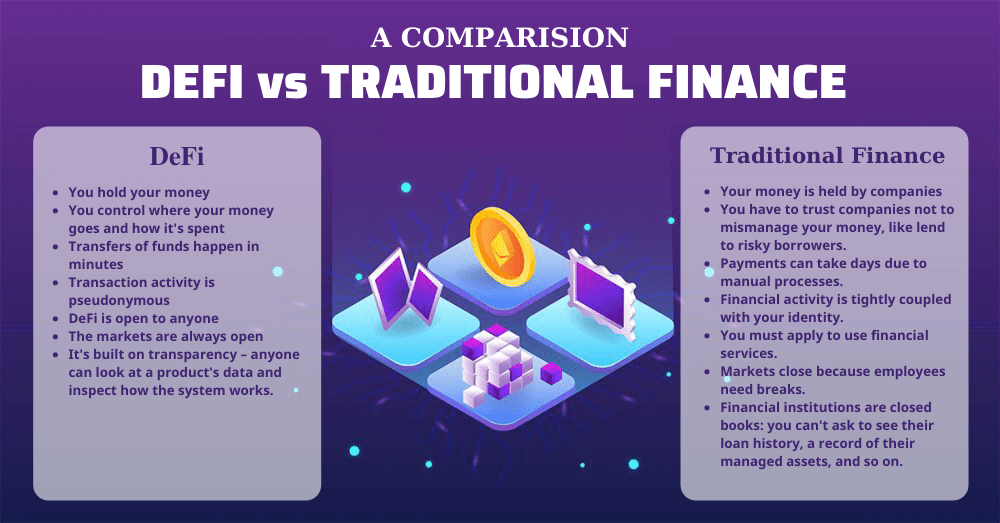

DeFi vs. Traditional Finance

Decentralized finance is often compared to the traditional financial system. However, the functionality and features of these systems are very different. While financial systems are centralized and controlled by a few centralized institutions, DeFi is decentralized and controlled by no single entity.

This has implications for how the systems operate, particularly in terms of financial stability. Because of their centralized nature, financial systems are susceptible to collapse when one of the central institutions fails.

This was seen in 2008 when the collapse of Lehman Brothers caused a global financial crisis.

Because DeFi is decentralized, no single individual or institution is responsible for the financial stability of the system as a whole. This means that a collapse of any particular network won’t affect the overall financial system, although people who use the specific network will be impacted.

Benefits of DeFi

– Financial sovereignty: Decentralized finance allows users to transact directly with each other and bypass centralized financial institutions, which means that you have complete control over your funds. This gives you a high degree of financial sovereignty and freedom.

– Financial inclusion: Because decentralized finance is accessible to anyone with access to the internet, it has the potential to bring billions of people into the financial system. This can benefit the global economy by helping people become more financially and socially productive.

– Lower fees: Most financial services have high fees. This is because intermediaries such as banks have to be compensated for managing the risk their role presents. With DeFi, there are no intermediaries that need to be paid, so you can save money while still accessing a quality service.

– Financial stability: While traditional financial systems are centralized, which makes them vulnerable to failure, DeFi is decentralized, which makes it more stable.

DeFi Risks and Security Considerations

Although decentralized finance offers many benefits, it also comes with some risks and considerations.

Because DeFi is decentralized, it can’t be regulated. This means that you may not receive the same protections as you would with a centralized financial system. For example, if you borrow money, the terms and conditions of the contract are entirely up to the lender. You also have no guarantee of payment if the lender chooses not to pay.

There is also a risk that a malicious user may disrupt the entire system by hacking a single node in the network. However, decentralized protocols, such as Hydro Protocol, are being developed to reduce the risk of network disruption.

Decentralized finance also comes with security considerations. Because it’s a new system and there is no unified security protocol, decentralized financial services and exchanges have been the target of hacks and other malicious activity. To protect yourself, you should always stay updated on the latest security news and make sure that you have the latest security patches and have taken all necessary precautions. You should also only use decentralized financial services from reputable providers like MakerDao, Curve or AAVE.

Conclusion and Outlook for DeFi

Decentralized finance is a revolutionary new financial system that has the potential to completely change the way that people interact with each other and access financial services. The sector has only just gained traction and is set to grow and evolve rapidly as more people discover the benefits of using it. As it matures, decentralized finance will likely become an essential part of the global financial system, bringing many benefits to billions of people across the world.

The future is exciting, and it holds a lot of promise for a more equitable, open, and efficient financial system.

DeFi Glossary

Get your free copy of my DeFi glossary PDF at this link. I will send it over to you right away.