What is a Cryptocurrency Exchange and How Does It Work?

Cryptocurrency exchange platforms have become increasingly popular over the past few years. As the demand for digital currencies such as Bitcoin, Ethereum, and Litecoin has grown, so has the need for reliable and secure exchanges. In this blog post, we’ll explore what a cryptocurrency exchange is, different types of exchange platforms, factors to consider when choosing a cryptocurrency exchange platform, the best cryptocurrency exchange platforms, and the advantages and disadvantages of using cryptocurrency exchanges.

Table Of Contents

- Introduction to Cryptocurrency Exchange Platforms

- Different Types of Cryptocurrency Exchanges

- Factors to Consider when Choosing a Cryptocurrency Exchange Platform

- The Best Centralised Exchanges (CEXs)

- The Best Decentralised Exchanges (DEXs)

- Anonymous Cryptocurrency Exchange Platforms

- Peer-to-Peer (P2P) Exchanges

- Advantages of Using Cryptocurrency Exchanges

- Disadvantages of Using Cryptocurrency Exchanges

- Conclusion

Introduction to Cryptocurrency Exchange Platforms

A cryptocurrency exchange is a platform that allows users to buy, sell, and trade digital currencies.

These exchanges act as a middleman between buyers and sellers, providing a secure and regulated environment for trading.

By using a cryptocurrency exchange, users can access a variety of digital currencies and convert them into fiat money or other digital assets. The most popular exchanges include Coinbase, Binance, and Huobi.

Cryptocurrency exchanges provide a range of services, including the ability to store digital assets, as well as providing a platform for trading between different digital currencies.

They also provide a variety of tools and features, such as market analysis and charting, to help users make informed trading decisions.

When using a cryptocurrency exchange, users need to be aware of the risks associated with trading digital assets. As with any other type of trading, there is always the risk of losing money.

It is important to research the exchange and read reviews before using it.

REALLY IMPORTANT! When using a centralised cryptocurrency exchange you don’t own your private keys. It’s really important to store your cryptocurrency private keys securely in a hardware wallet, also known as cold storage. My favourite choice is the Ledger Nano X or the new Ledger Nano S Plus. There also are other alternatives like Trezor Model One, Trezor Model T or SafePal.

Different Types of Cryptocurrency Exchanges

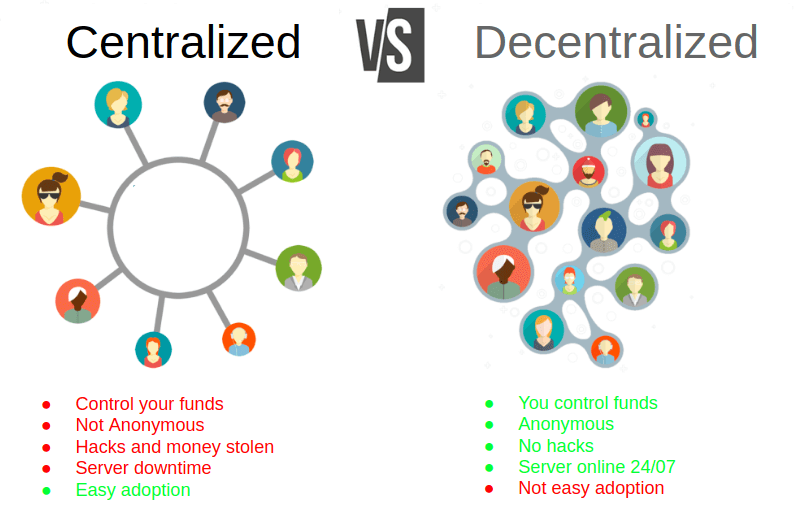

There are two main types of cryptocurrency exchanges – centralized and decentralized.

Centralized exchanges are the most common type of exchange and require users to register an account with the exchange in order to trade. These exchanges are typically more secure and regulated, as they are subject to KYC (Know Your Customer) and AML (Anti Money Laundering) regulations.

Decentralized exchanges, on the other hand, do not require users to register an account with the exchange. These exchanges are less regulated and are designed to be more secure than centralized exchanges. They use blockchain technology to ensure that transactions are secure and private.

In addition to centralized and decentralized exchanges, there are also peer-to-peer (P2P) exchanges. These types of exchanges allow users to trade directly with each other without the need for a middleman. These exchanges are usually more secure and offer lower fees than centralized exchanges. However, they can be more difficult to use and are not as well-regulated as centralized exchanges.

Factors to Consider when Choosing a Cryptocurrency Exchange Platform

When choosing a cryptocurrency exchange platform, there are several factors to consider.

These include the fees charged by the exchange, the types of digital currencies offered, the liquidity of the exchange, the security features offered, and the customer support available. It is important to compare the fees charged by different exchanges to ensure you are getting the best deal.

When choosing an exchange platform, it is also important to consider the types of digital currencies offered. Many exchanges offer a wide range of digital currencies, including Bitcoin, Ethereum, Litecoin, and Ripple. It is important to make sure the exchange offers the digital currencies you are interested in trading.

In addition, it is important to consider the liquidity of the exchange. Liquidity refers to the amount of digital currency available for trading on the exchange. If the exchange does not have enough liquidity, it may be difficult to execute trades.

Finally, it is important to consider the security features offered by the exchange. Most exchanges offer two-factor authentication, which requires users to enter a code sent to their email or phone number in order to access their accounts. In addition, many exchanges offer cold storage, which is a secure offline method of storing digital currencies.

The Best Centralised Exchanges (CEXs)

When finding the best-centralised exchanges (CEXs), it is essential to look at the fees, security features, liquidity, customer support, and digital currencies offered.

Here is a list of my top picks for the best exchanges in 2023: Coinbase, Binance, Huobi, Kraken, Bitstamp, and Gemini.

Coinbase is one of the most popular exchanges, offering a variety of digital currencies, competitive fees, and high liquidity. In addition, Coinbase offers excellent customer support and advanced security features, making it a great choice for both experienced and beginner traders.

Binance is another popular exchange, offering a wide range of digital currencies and competitive fees. In addition, Binance offers high liquidity and advanced security features, making it a great choice for experienced traders.

Huobi is a secure and reliable exchange, offering a variety of digital currencies and competitive fees. In addition, Huobi offers excellent customer support and advanced security features.

Kraken is a secure and reliable exchange, offering a wide range of digital currencies, competitive fees, and high liquidity. In addition, Kraken offers advanced security features and excellent customer support, making it a great choice for both experienced and beginner traders.

Bitstamp is a secure and reliable exchange, offering a variety of digital currencies, competitive fees, and high liquidity. In addition, Bitstamp offers advanced security features and excellent customer support, making it a great choice for both experienced and beginner traders.

Finally, Gemini is a secure and reliable exchange, offering a variety of digital currencies, competitive fees, and high liquidity. In addition, Gemini offers advanced security features and excellent customer support, making it a great choice for both experienced and beginner traders.

You can also book a 1-on-1 call with me if you would like to learn more about how to create an account on the exchanges or about crypto and investments in general.

The Best Decentralised Exchanges (DEXs)

Decentralized exchanges, or DEXs, are blockchain-based apps that let individuals trade cryptocurrency in a non-custodial way rather than the traditional method of serving as a financial middleman among market participants.

Platforms can have a wide variety of infrastructure and system designs, with many crypto DEXs having liquidity pools, novel order books, and DeFi features, such as consolidation tools for unique and innovative investment products.

When you hold your crypto on a centralized exchange, it takes control of your funds. With the DEX, though, you stay in control of your assets; thus, this is considered a safer way to trade crypto.

Now that you know a little bit more about exchanges, it’s time to learn about the best-decentralized exchanges available on the market.

The 1inch exchange is one of the best-decentralized exchanges. It split the order into several decentralized exchanges to avoid high price slippage. Balancer is another excellent choice, offering users automatic liquidity for deals, allowing the network to remain entirely decentralized and using BNT tokens to ease transactions.

Other platforms to consider include DexGuru, dYdX, AirSwap, Bancor, Bisq, CowSwap, Curve, PancakeSwap, SushiSwap and UniSwap. Each of these exchanges offers unique features and advantages that make them a good choice for those looking for a decentralized exchange.

For example, Bancor provides users with automatic liquidity for deals, while Curve is an exchange liquidity pool on Ethereum designed for highly efficient stablecoin trading. AirSwap, on the other hand, offers peer-to-peer token trading on Ethereum without trading fees.

In conclusion, the best-decentralised exchange platforms are 1inch, Balancer, Bancor, Bisq, CowSwap, Curve, DexGuru, dYdX, AirSwap, PancakeSwap, SushiSwap and UniSwap. Each of these platforms has its advantages and features, so it’s important to research and compares them to find the best one for your needs.

Anonymous Cryptocurrency Exchange Platforms

Centralised cryptocurrency exchange platforms allow users to purchase, sell, and trade digital assets like Bitcoin, Ethereum, and Litecoin.

These exchanges provide a secure and convenient interface for users to store and transfer their digital assets. However, not all exchanges are created equal.

Anonymous cryptocurrency exchange platforms like DEXs or some CEXs, offer users the same convenience, but with an added layer of privacy and security.

Anonymous cryptocurrency exchanges like Bybit, Kucoin or our JSM Crypto exchange which is 100% anonymous and secure, don’t require users to provide personal information like an ID or bank account details.

Instead, users can make transactions and store their digital assets without revealing their identities. This makes anonymous cryptocurrency exchanges attractive to those who are concerned about the risks associated with revealing their personal information, or who value the anonymity of their transaction history.

In addition to providing anonymity to users, anonymous exchanges also provide additional security measures like two-factor authentication, advanced encryption protocols, and cold storage solutions. This helps ensure that user funds and data remain secure, even if the exchange is targeted by hackers.

In contrast to regular cryptocurrency exchanges, anonymous cryptocurrency exchanges are still relatively new. As such, users should be aware of the additional risks associated with using them, such as the lack of governmental oversight and potential liquidity issues.

Overall, anonymous cryptocurrency exchanges offer users an additional layer of privacy and security but it also has their risks.

Users should do their due diligence research before using any exchange.

Peer-to-Peer (P2P) Exchanges

P2P exchanges are online platforms which allow users to directly buy and sell cryptocurrency with each other.

They offer the advantage of not relying on a central authority, such as a bank or exchange, for payments and transactions. This offers users more control over their funds and the ability to conduct transactions outside of the traditional financial system.

P2P exchanges also come with their own set of risks, as they are not subject to the same regulations as other exchanges. This means that users must be especially careful when using them to protect their funds from potential scams.

It is important to research the platform and its users thoroughly before committing to any trades.

Additionally, users should always double-check the accuracy of their transactions before signing off.

Advantages of Using Cryptocurrency Exchanges

There are several advantages to using cryptocurrency exchanges.

The most important advantage is that they provide access to a variety of digital currencies and allow users to convert them into fiat money or other digital assets.

In addition, exchanges offer a secure and regulated environment for trading, as well as advanced tools and features to help users make informed trading decisions.

Cryptocurrency exchanges also offer competitive fees and high liquidity, making them a great choice for both experienced and beginner traders.

Many exchanges offer excellent customer support and advanced security features, making them a safe and secure choice.

Disadvantages of Using Cryptocurrency Exchanges

Although there are several advantages to using cryptocurrency exchanges, there are also some drawbacks.

The most important drawback is the risk of losing money when trading.

In addition, some decentralised cryptocurrency exchanges can be difficult to use and may not offer the same level of customer support as traditional exchanges. Furthermore, some exchanges may charge high fees, which can make trading less profitable.

Finally, it is important to be aware of the risks associated with trading digital assets. Cryptocurrency exchanges are subject to hacking, and users can lose their money if their accounts are compromised. As with any type of trading, it is important to be aware of the risks and to take steps to protect yourself.

Make sure to research the exchange and read reviews before using it.

Conclusion

In conclusion, cryptocurrency exchanges are an increasingly popular way to access digital currencies and convert them into fiat money or other digital assets.

When choosing a cryptocurrency exchange platform, it is important to consider the fees, security features, liquidity, customer support, and digital currencies offered.

Cryptocurrency exchanges offer several advantages, including access to a variety of digital currencies, competitive fees, high liquidity, and advanced security features.

However, it is important to be aware of the risks associated with trading digital assets and to take steps to protect yourself.

If you are interested in using a cryptocurrency exchange, I recommend doing research and reading reviews before selecting an exchange.

Here is a list of my top picks for the best-centralised exchanges in 2023: Coinbase, Binance, Kucoin, Crypto.com, Bybit, and Nexo Pro.

If you are interested in learning more about exchanges, trading or cryptocurrency in general, you can enrol in my courses or schedule a 1-on-1 video call with me.

I look forward to helping you on your cryptocurrency journey!