What is Cryptocurrency? The Basics and How It Works

Cryptocurrencies, also known as crypto coins, are digital mediums of exchange using encryption for security and control. Cryptocurrencies are peer-to-peer networks run directly through a decentralized blockchain. This means that instead of one company or organization running the system (like banks or governments), it’s maintained by a network of users who contribute resources and validate transactions. This decentralization is what makes cryptocurrencies so secure and useful in a variety of financial settings. Cryptocurrencies can be used to make fast, secure loans with minimal collateral risk, purchase properties that have tax advantages, and even support global microfinance institutions.

Cryptocurrencies are an exciting new asset class that offers tremendous potential benefits to investors, users, merchants, creditors, and service providers alike. In this article, we’ll cover everything you need to know about investing in cryptocurrency: from the basics and risks involved to how they work today, where they’re headed tomorrow, and why you should get started right now if you haven’t already.

Table Of Contents

1. What is Cryptocurrency?

2. How Does Cryptocurrency work?

- What is Cryptography

- What is Crypto Mining

3. Advantages of investing in cryptocurrency

4. Risks of investing in cryptocurrency

5. Why is cryptocurrency the future of finance?

6. How to buy Bitcoin and other cryptocurrencies

7. Final Words: Should you invest in cryptocurrency?

What is Cryptocurrency?

Cryptocurrency is a digital currency that uses cryptography to secure and verify transactions and control the creation of additional currency units, making it a decentralized form of payment. Put simply, it’s digital money.

Cryptocurrencies use decentralized control to eliminate the need for a central bank or single administrator. They are usually generated through mining, which requires miners to solve complex algorithms.

One of the most significant benefits of cryptocurrency is that it’s decentralized: it’s not controlled by any single entity or government. This means that cryptocurrencies are free from the influence of banks and other third parties, so they’re immune to bank fees and interest rates. You can also store your cryptocurrency in a virtual wallet, which allows you to use them just like regular money.

Cryptocurrency is also borderless and anonymous, so you can use it anywhere in the world without worrying about restrictions or fees. It’s also extremely secure: since there’s no central authority controlling it, there’s no way for hackers to access your account. And since transactions are encrypted, no one can track your cryptocurrency balance or history.

You can purchase, sell, and trade it via online exchanges or IRL (in real life) meet-ups and trading platforms. As a medium of exchange, cryptocurrency can be used to buy & sell goods and services, trade equity, and make fast, secure, and low-cost payments. It’s also used to store and send money across the globe at low cost, similar to how the US dollar is used today.

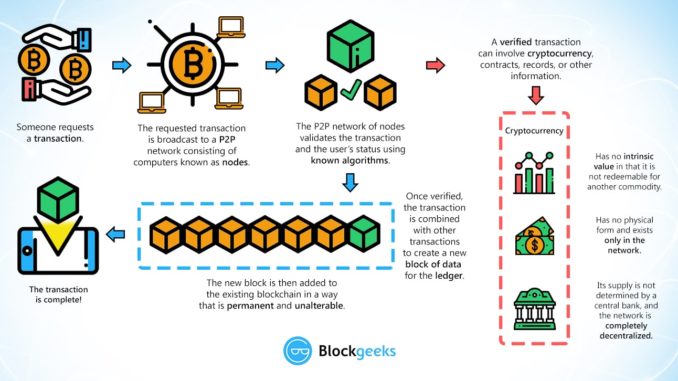

How Does Cryptocurrency work?

Cryptocurrencies are digital assets that are created and managed through the use of cryptography.

Cryptocurrencies use cryptography and blockchain technology to regulate the creation of new units and track the transfer of assets. Open-source and proprietary software are both used to build cryptocurrencies, which include a network of miners who prevent fraud, a wallet where users store their public and private keys, and a blockchain that records transactions.

Decentralized control instead of centralized management is used in cryptocurrencies. This means that the management of currency and contract processing would be executed by multiple individuals. The popularity of cryptocurrencies has risen over the past few years as a payment mechanism. This has been primarily due to the decentralized nature of cryptocurrencies and the absence of centralized management. This allows for faster processing times and lower transaction charges to incentivize decentralized processing.

Cryptocurrencies like Bitcoin are attractive because they facilitate quicker and less expensive transactions due to the absence of centralized banks as intermediaries.

What is Cryptography?

Cryptography is a method of securing communication, and blockchain technology is a decentralized host of records that are distributed across every user’s device. Put simply, cryptography is a method of securing information while blockchain technology is a function of distributing data across all users’ devices.

It can be used for a variety of purposes, including ensuring the privacy of information, preventing unauthorized access, and ensuring the integrity of data. In general, cryptography is the process of converting ordinary data into unreadable code. This code can then be used to ensure that the data remains confidential

What is Crypto Mining?

Crypto mining is the process of using a computer to solve complex math problems (known as “cryptography”) in order to verify transactions and create new Bitcoin or other cryptocurrencies. The first miners to solve these problems are rewarded with new coins. The process is very energy intensive, so in order to keep mining, you need to buy new computers or join a mining pool with others.

The decentralized nature of cryptocurrencies means that there is no central authority that can control mining activity, so this activity is completely open. Anyone can join the mining effort by downloading a mining software package, either on a home computer or a cloud-based server.

Advantages of investing in Cryptocurrency

There are several advantages of investing in Cryptocurrencies in general.

Here are some examples:

– Can be used from anywhere in the world.

– Are durable enough to be used repeatedly without deteriorating.

– Are irreversible so that transactions cannot be reversed and units cannot be spent twice.

– Do not require identification or permission to create wallets.

– Are pseudonymous, meaning no identifying information is attached to transactions.

Risks of investing in Cryptocurrency

Cryptocurrencies have many risks, including the danger of losing money if security is breached or if the value of a given cryptocurrency falls too low. There also is a risk that new cryptocurrencies could become worthless and worthless cryptocurrencies could be reclassified as securities.

Finally, there are many unknowns about the future of cryptocurrencies and other crypto assets, such as how they will hold up in the face of hackers and other cybersecurity threats.

There are also tax implications associated with investing in cryptocurrencies. For example, Crypto-to-crypto trading may be subject to capital gains taxes. In addition, investors who trade in cryptocurrencies may be required to pay self-employment taxes.

These are the most common risks explained:

- Fraud – Like any other asset class, cryptocurrency is susceptible to fraud. Users can lose money when they send it to a scammer or hacker, or when they purchase a bad/faulty product. Furthermore, the cryptocurrency market is open and decentralized, which makes it difficult to police.

- Volatility – Unlike traditional stocks where the volatility is minimal, the price of most cryptocurrencies typically fluctuates significantly. This can make investing in them risky, as you could see large profits followed by large losses.

- Lack of Regulation – Cryptocurrency markets are largely unregulated, which makes it difficult to predict the future value of coins. This may be a risk to investors who believe they will rise in value with inflation, or fall with deflation.

- Lack of Education – Cryptocurrency markets aren’t easy to navigate, especially if you are a beginner investor. Before starting your journey make sure you have learned at least the basics.

To minimize these risks, it’s important to do your homework before investing in a cryptocurrency. Make sure you understand the underlying technology and the risks involved. And consider educating yourself before making any decisions!

JSM Crypto is here to help educate you.

Why is Cryptocurrency the future of finance?

Cryptocurrencies are the first alternative to the traditional banking system and offer a range of advantages to previous payment methods and traditional asset classes. They are a new form of cash that exists solely on the internet, making them the fastest, easiest, safest, and most universal method to exchange value that the world has ever seen.

– Security – As the internet moves from its current centralized infrastructure to a decentralized blockchain-based system, security will improve. This will make cryptocurrency more secure and reliable, which may be useful in the future as the world transitions to a cashless society.

– Privacy – Users can maintain their privacy when using cryptocurrencies, which may prove useful in the future as governments and businesses alike attempt to track and monitor individual activity.

– Scalability – Cryptocurrency technology may be able to support a larger number of users and offer more transactions than current blockchain technology.

– Usability – Cryptocurrency wallets are generally easy to use and are becoming more mainstream. This may also be useful in the future as the world transitions to a cashless society.

– Cost-Effectiveness – By using a decentralized blockchain system to validate transactions, cryptocurrency can offer a low-cost transaction network.

How to buy Bitcoin and other Cryptocurrencies

Buying Bitcoin and other Cryptocurrencies on exchanges like Binance, Kucoin, Bybit or Crypto.com is the easiest method. You can find the links to these exchanges below.

You can buy major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), Solana (SOL), and Polkadot (DOT) as well as other emerging cryptocurrencies.

If you know what you’re hoping to do with cryptocurrency, you may choose the currency that best suits your objectives. For example:

- If you want to make online purchases then you should go with a widely accepted cryptocurrency such as Bitcoin or Ethereum.

- If you want to diversify your investment portfolio then you might want to consider a ‘risk on/risk off’ approach and choose one of the emerging cryptocurrencies.

- If you want to help advance technology in the form of developing new blockchain platforms then you might want to consider one of the up-and-coming cryptocurrencies.

- If you want to be part of a cryptocurrency community and learn more about the technology behind it then you might want to consider one of the Proof of Work cryptocurrencies like Bitcoin.

Keep in mind that you do not need to buy a whole coin. In an exchange, you can buy portions of coins in increments as little as 5 dollars, euros, pounds, or your local currency.

⬇️ EXCHANGE LINKS TO BUY CRYPTO ⬇️

Final Words: Should you invest in Cryptocurrency?

Cryptocurrencies are an exciting new asset class that offers tremendous potential benefits to investors, users, merchants, creditors, and service providers alike. This is especially true if you invest in Bitcoin, as this is currently the most popular cryptocurrency. However, there are a few things to keep in mind before diving in.

First, cryptocurrencies are extremely risky and volatile. Like stocks, they can also go to zero, but they can also provide huge returns. The major difference is that they are extremely risky and volatile due to their decentralized nature.

Investing in cryptocurrencies is extremely speculative, and it’s important to approach this with extreme caution. Also, remember that you should generally only invest what you can afford to lose.

WRITTEN BY JOSE

Jose is full-time investor, business owner and educator. He is the founder of JSM Crypto, a platform that was created to help people get educated in crypto.

Subscribe To Our Free Educational Newsletter

Our bi-monthly newsletter will keep you up to date on major events in the cryptocurrency sector. We will also share trading and investing ideas, tips, and tricks with you, all while continuously improving your knowledge and understanding of the investment world.

By subscribing you agree to the Terms of Use and Privacy Policy

No Comments