The History of Money: How Currency has Evolved Throughout the Ages

Have you ever stopped to consider the history of money? How did it come about and what forms has it taken throughout the ages? In this blog post, we’ll explore the fascinating history of money and how it has evolved from bartering to coins to paper money and digital currencies. We’ll also explore the impact of blockchain technology and artificial intelligence on the future of money and financial management.

Table Of Contents

Introduction: A Brief History of Money

What is Money?

The Evolution of Money: From Bartering to Coins

- Precious Metals and Paper Money

The Industrial Revolution and the Emergence of Credit Cards

Central Banks and the Standardization of Money

- The Rise of Cryptocurrency and Digital Currencies

- The Impact of Blockchain Technology

- The Future of Money: Artificial Intelligence and Automated Financial Transactions

- Financial Management: The Benefits of Automation

Conclusion

Introduction: A Brief History of Money

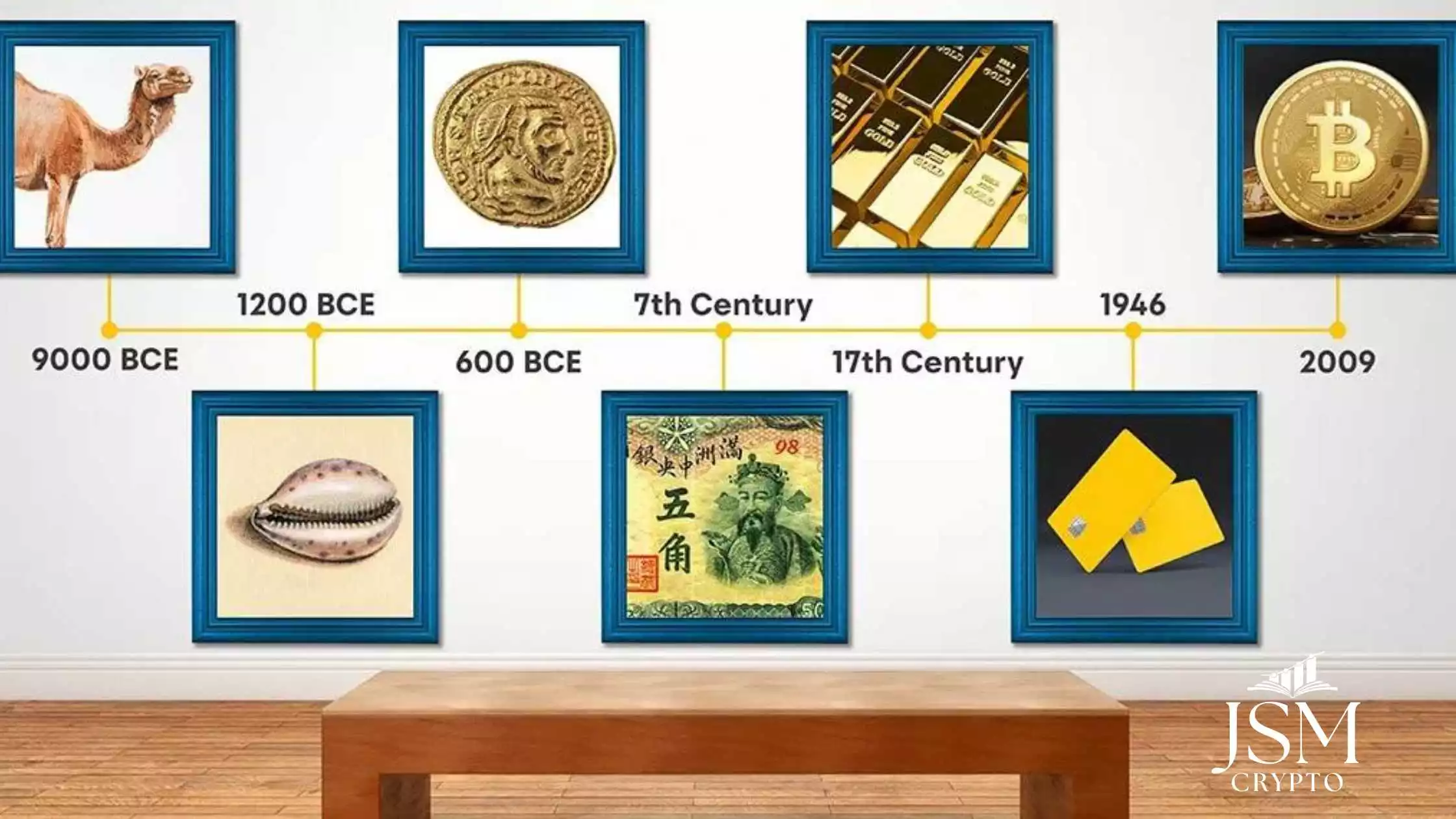

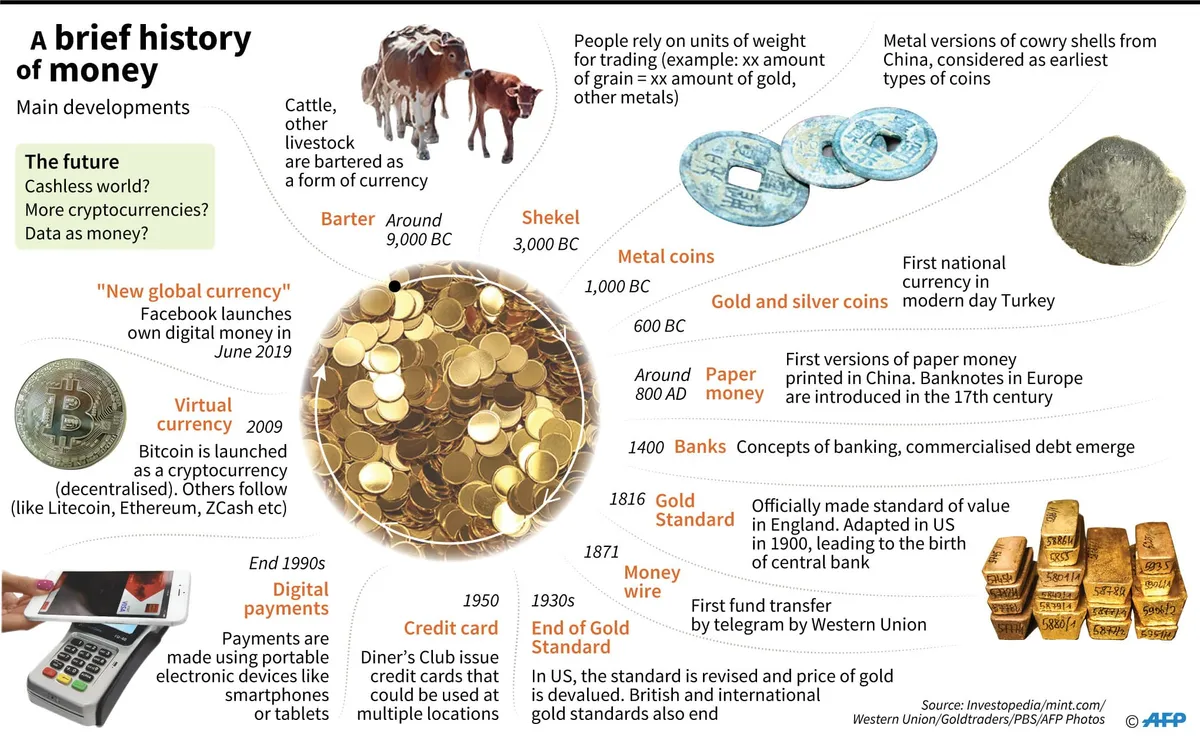

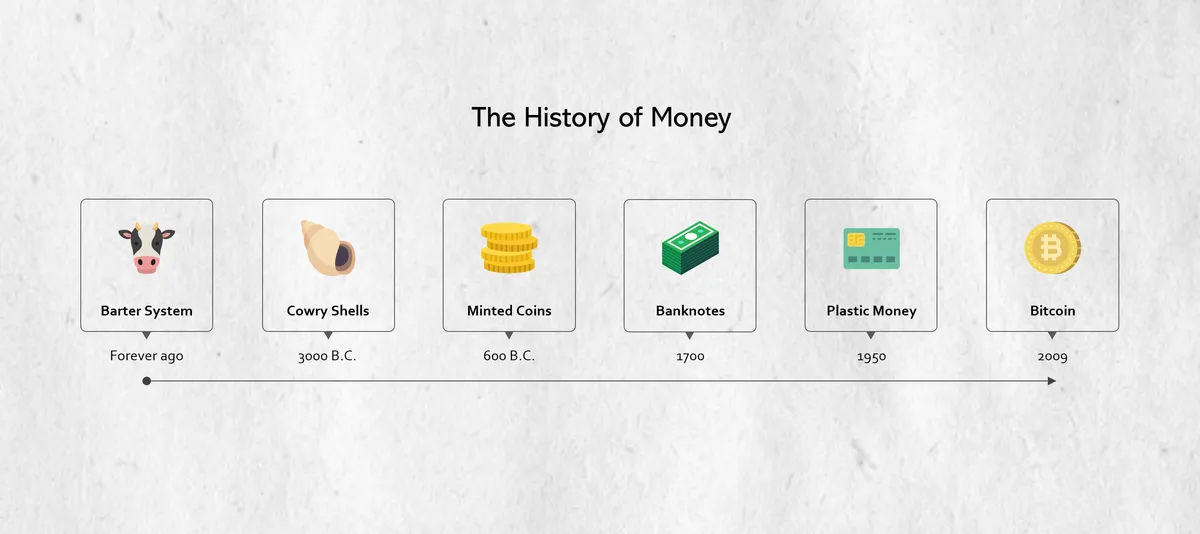

The history of money and currency is a long and complex one, spanning thousands of years.

Throughout history, people have used a variety of different means of exchange, from bartering and coins to paper money and credit cards, each system having its own unique characteristics.

With the advent of cryptocurrency, money is now entering a new chapter in its history, one that will likely have a significant impact on the global economy and society as a whole.

What is Money?

The concept of money has been around for centuries. It’s a form of exchange that is used to purchase goods and services.

Money is also a way to store, measure, and transfer wealth. In essence, money is a form of agreement between parties.

Before money came about, people used bartering to exchange goods and services. This involved trading one item for another item of equal value. For instance, one might trade a cow for 10 chickens. This system was inefficient and cumbersome, as it was difficult to find someone who wanted to trade for the exact item that you had.

The Evolution of Money: From Bartering to Coins

The development of coins marked a major milestone in the history of money.

Coins originated in the Middle East around 2500 BC. Initially, coins were made of precious metals, such as gold and silver, and were used as a form of currency. Coins were a more efficient way of trading since they had a set value and could be exchanged for goods and services.

As coins became more popular, people began to use them as a way to store wealth. This led to the creation of banks, which were used to store and manage money. Banks also began to issue loans and other financial instruments, such as checks and money orders.

Precious Metals and Paper Money

The use of precious metals as a currency continued until the mid-1800s. During this time, paper money was introduced.

This was a more efficient and cost-effective way of exchanging money, as it was easier to transport than coins. Paper money was also easier to counterfeit, which led to the emergence of paper money fraud.

In response to this problem, governments began to issue currency notes backed by gold and silver. This ensured that a tangible asset backed the value of paper money.

This system remained in place until the early 1900s when governments began to issue paper money without the backing of gold or silver.

The Industrial Revolution and the Emergence of Credit Cards

The industrial revolution changed the way people used money.

With the introduction of new technologies, it became easier to produce and transport goods. This led to an increase in trade and commerce, and money became more widely available.

In the mid-1900s, credit cards were introduced. This was a revolutionary concept that allowed people to borrow money and pay for goods and services without having to carry cash. Credit cards allowed people to purchase goods and services without having to worry about carrying large sums of money.

Central Banks and the Standardization of Money

The emergence of central banks marked a major milestone in the history of money.

Central banks were responsible for setting monetary policy, issuing currency, and regulating the banking system. By standardizing money, central banks helped to stabilize the economy and reduce the risk of inflation.

Central banks also began to issue fiat money, which is money that is not backed by a tangible asset. This allowed governments to issue money without having to worry about storing gold or silver.

Today, most countries use fiat money as a form of currency.

The Rise of Cryptocurrency and Digital Currencies

The rise of cryptocurrency and digital currencies marked a major shift in the way money is used.

Cryptocurrencies, such as Bitcoin, are digital currencies that are decentralized and not controlled by any central authority. These digital currencies are secured using cryptography and are stored in digital wallets.

Cryptocurrencies have become increasingly popular in recent years due to their low transaction fees and fast transaction times. They also provide a level of anonymity that is not available with traditional currencies.

The Impact of Blockchain Technology

The emergence of blockchain technology has had a major impact on the financial services industry.

Blockchain is a distributed ledger technology that enables peer-to-peer transactions without the need for a central authority. This technology has enabled the development of new financial products and services, such as digital currencies and smart contracts.

Blockchain technology also has the potential to revolutionize the way financial transactions are conducted. For instance, blockchain-based platforms can facilitate faster and more secure payments, as well as provide access to new financial products and services.

The Future of Money: Artificial Intelligence and Automated Financial Transactions

The emergence of artificial intelligence (AI) and machine learning has opened up a world of possibilities for the future of money.

AI-powered systems can be used to automate financial transactions and investment decisions, making it easier for individuals to manage their finances.

AI-powered systems can also be used to detect fraudulent activity, reducing the risk of fraud.

Moreover, AI can be used to develop personalized financial solutions for individuals. This could include automated investment advice and personalized financial products.

This could allow individuals to make more informed decisions about their finances and reach their financial goals.

Financial Management: The Benefits of Automation

Automation has the potential to revolutionize the way we manage our finances.

Automated financial systems can:

- Make it easier to manage our money and increase our financial literacy.

- Reduce the risk of fraud, as well as save time and money.

- Provide individuals with access to personalized financial products and services.

This could include automated advice, personalized investment portfolios, and automated budgeting tools.

By automating financial processes, individuals can make more informed decisions about their finances and reach their financial goals.

Conclusion

The history of money is fascinating. From bartering to coins to paper money and digital currencies, money has taken many forms throughout the ages. We’ve seen the emergence of central banks, credit cards, and blockchain technology, as well as the potential of artificial intelligence and automated financial transactions.

The use of money is constantly evolving. As technology advances, it’s likely that we will see more innovative forms of money, as well as new ways to manage our finances.

If you’re looking to make more money, increase your financial literacy, and gain greater financial freedom, then don’t wait any longer. Sign up for one of my courses and get started today!

As a bonus, you can also take advantage of my 1-on-1 coaching service in order to maximize your financial goals.

With my help, you can make the most of your financial opportunities and reach your fullest potential. Join now and begin your journey to financial success.

WRITTEN BY JOSE

Jose is full-time investor, business owner and educator. He is the founder of JSM Crypto a platform that was created to help people get educated in crypto.

Subscribe To Our Free Educational Newsletter

Our bi-monthly newsletter will keep you up to date on major events in the cryptocurrency sector. We will also share trading and investing ideas, tips, and tricks with you, all while continuously improving your knowledge and understanding of the investment world.

No Comments